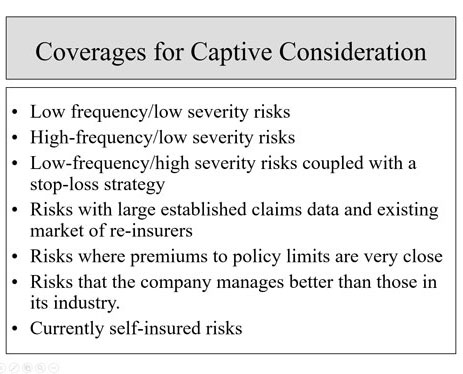

At this point hopefully you are thinking a captive sounds great, but are wondering exactly what kinds of coverage can be written and what are the limitations? First, it’s important to understand that there are certainly types of coverages that are better suited for a captive. These are identified in the table below:

Low frequency/low severity claims

Sometimes it doesn’t make sense to carry traditional insurance for claims that rarely occur and even when they do occur they are always of low-severity. Traditional insurance might not be available or it may be expensive since the carriers may charge a minimum amount for the coverage. In this case, an appropriate captive policy can balance the need for coverage and the need for appropriate premium pricing based on the individual organization’s risk profile.

High-frequency/low severity claims

Some companies experience a high number of low-severity (or low-cost) claims. Purchasing insurance coverage in the traditional market for this type of claim can be expensive because of the high-frequency nature of the loss history. A captive can make appropriate adjustments thereby reducing the overall cost of financing the risk.

Low-frequency/high severity coupled with a stop-loss strategy

When claims related to a particular risk occur very infrequently but the potential loss is severe, companies often find themselves paying very high premiums for events that rarely if ever occur. For those companies who have programs or procedures in place to reduce or eliminate the risk of such claims and who wish to reduce the cost of financing whatever underlying risk actually exists, a captive is often a good alternative. This works, however, only when there is a sound stop-loss strategy in place to ensure that if a severe claim does occur, there is appropriate excess coverage to handle it.

Risks with large established claims data and existing market of re-insurers

Most captives rely on reinsurance to handle much of the risk shifting. When there is an existing strong market for the reinsurance sought and there is well-established claims data, there is a good chance that the reinsurance will be very competitively priced and easy to secure. In this case, there is a good chance the overall program to underwrite these risks using a captive will be more financially attractive to the insured than simply buying traditional insurance.

Risks where premiums to policy limits are very close

If you are purchasing coverage from a traditional carrier and the premiums you are paying are not too different than your policy limits, you would likely benefit from having the captive underwrite that risk. First, the captive coverage will be less expensive because even for the same policy, the captive’s overhead is much lower than the traditional carrier. Second, you are getting almost no benefit from the traditional insurance if you are paying out about as much as you would hope to get back in the event of a loss. You are much better off paying the premium to yourself (i.e., to your captive) taking the deduction and then investing the money according to your captive’s investment policy.

Risks that the company manages better than those in their industry

A large interstate trucking company has achieved a significantly better safety record than the average comparable-size company for the past five years. Each year, the company enhances its safety program that already has a full-time dedicated staff of ten people. Every quarter, the company requires its drivers to attend two-day safety courses, which include classroom and practical safety training. The safety department staff reviews all Department of Transportation and National Highway Traffic Safety Administration reports, studies, bulletins and statistics to ensure any new findings or risks are incorporated into the company’s safety training programming. The company enforces a no-tolerance safety policy that includes immediate termination for specified safety violations. As a result of its efforts, the company has experienced sharply fewer claims than any other trucking company in their category. However, despite these efforts, the company’s insurance premium payments are only slightly lower than their competitors. The standard industry response to their consistent inquiry about why they are not seeing any significant improvement in their premium rates based on their performance is simply that the industry is seeing increased truck traffic and in many segments, increased claims. The company is told that these risks must be incorporated into the overall risk profile and that although their results have been exemplary, the underwriters need to see more than five years performance to ensure that this performance is not an anomaly. Here is an example of where the trucking company would benefit from having a captive write liability coverage. Clearly, the company’s results can be linked to their professional and aggressive approach to safety. The insurance industry is in effect using this company’s inflated premiums to cover the cost of claims incurred by less-diligent insureds in their category.

When your company has figured out a way to manage risk significantly better than others in your industry, writing coverage for that risk through a captive should be a consideration.